3 Maps to Review Your Territories and Find New Markets

When you are making your sales and growth plans, three questions matter a lot:

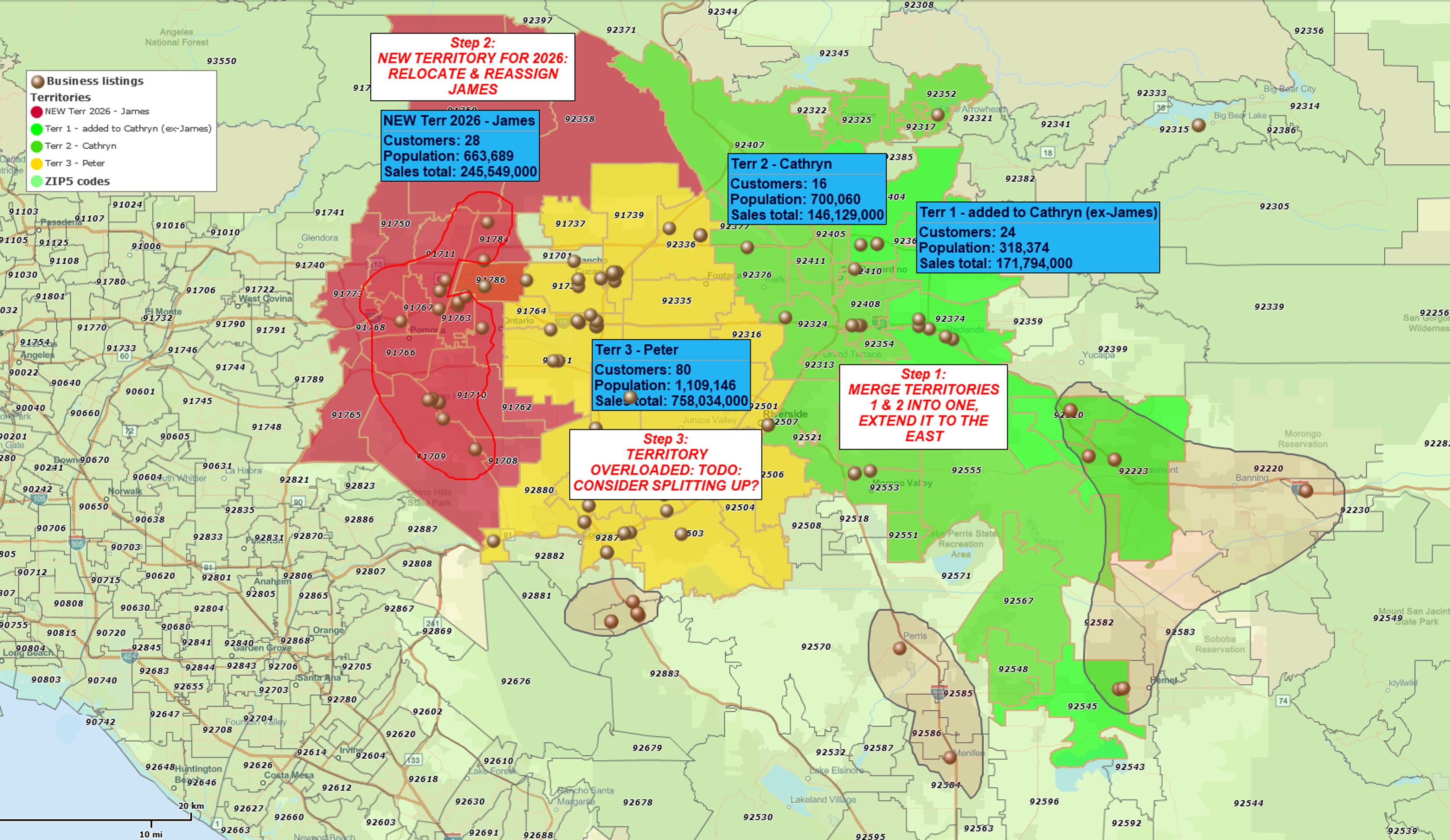

- Are your territories aligned with what’s really happening on the ground?

- Are those territories balanced across sales reps and regions?

- Are you focusing on the right markets to support growth?

Here are three practical maps you can build in MapBusinessOnline to answer those questions quickly.

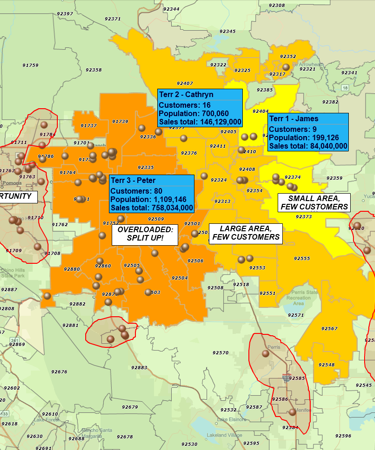

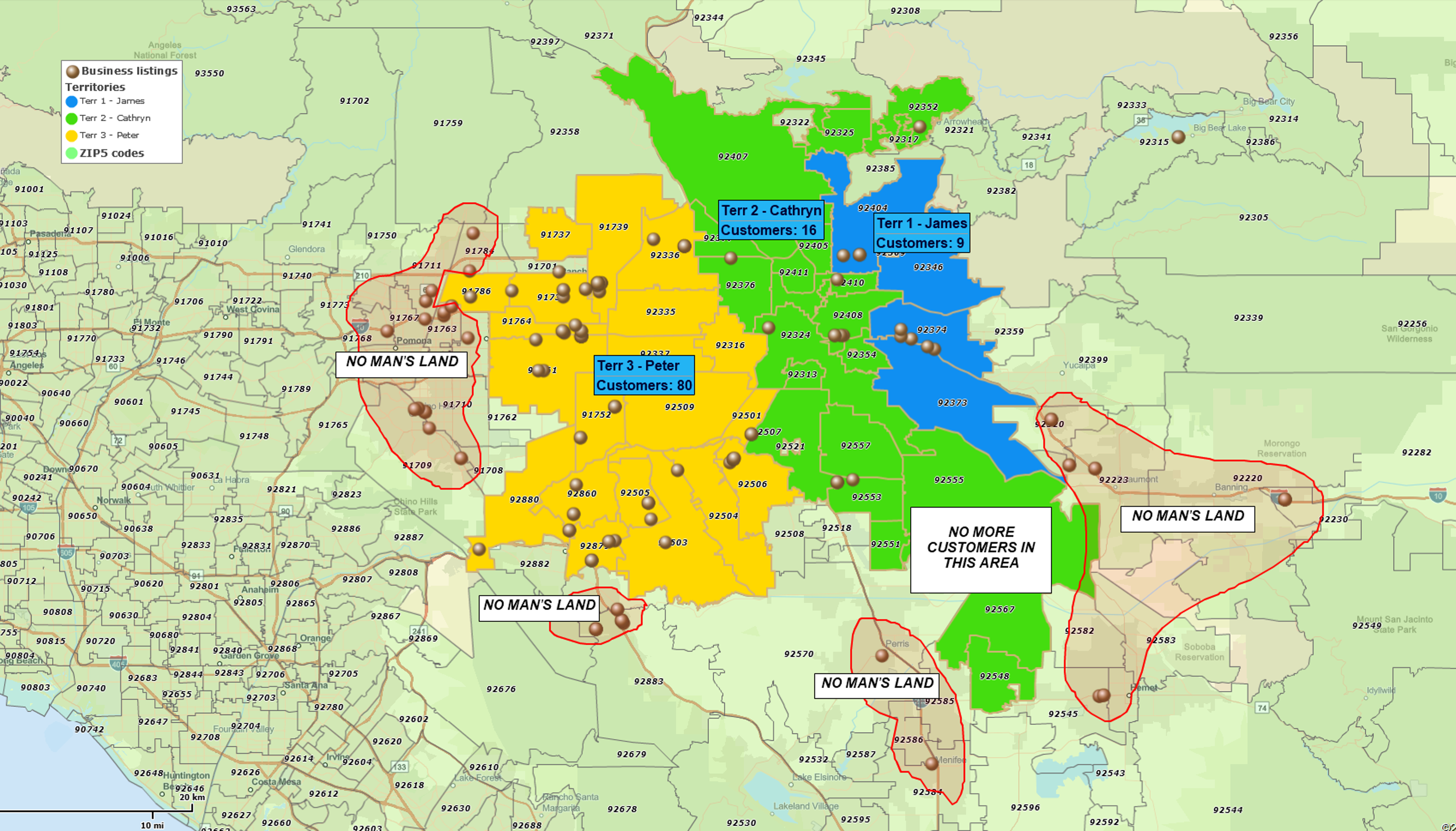

Map 1 – Territory Reality Check (Customers vs. Current Territories)

What this map tells you

- Where your customers actually cluster

- Whether your current territories still make sense

- Which areas are effectively “no man’s land”

What to do in MapBusinessOnline

- Import your latest customer list (with addresses or ZIP codes)

- Import your current territory assignments (e.g. ZIP code with assigned rep name spreadsheet)

- Use a simple symbol or density/heat map view for customers dataset so clusters stand out

- Label territories with customer count or revenue values so imbalances are obvious

What to look for

- Territories that have lots of customers far from the assigned rep’s base

- ZIPs or counties that have customers but no clear territory ownership

- Territories that look “fine” in a list but are clearly oversized or oddly shaped on the map

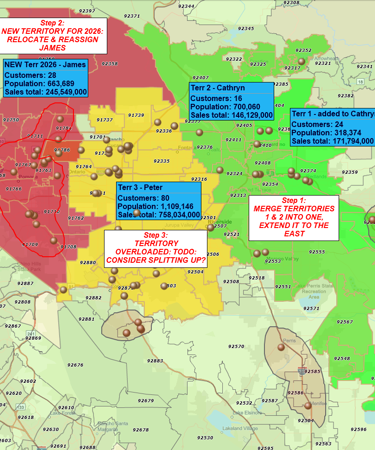

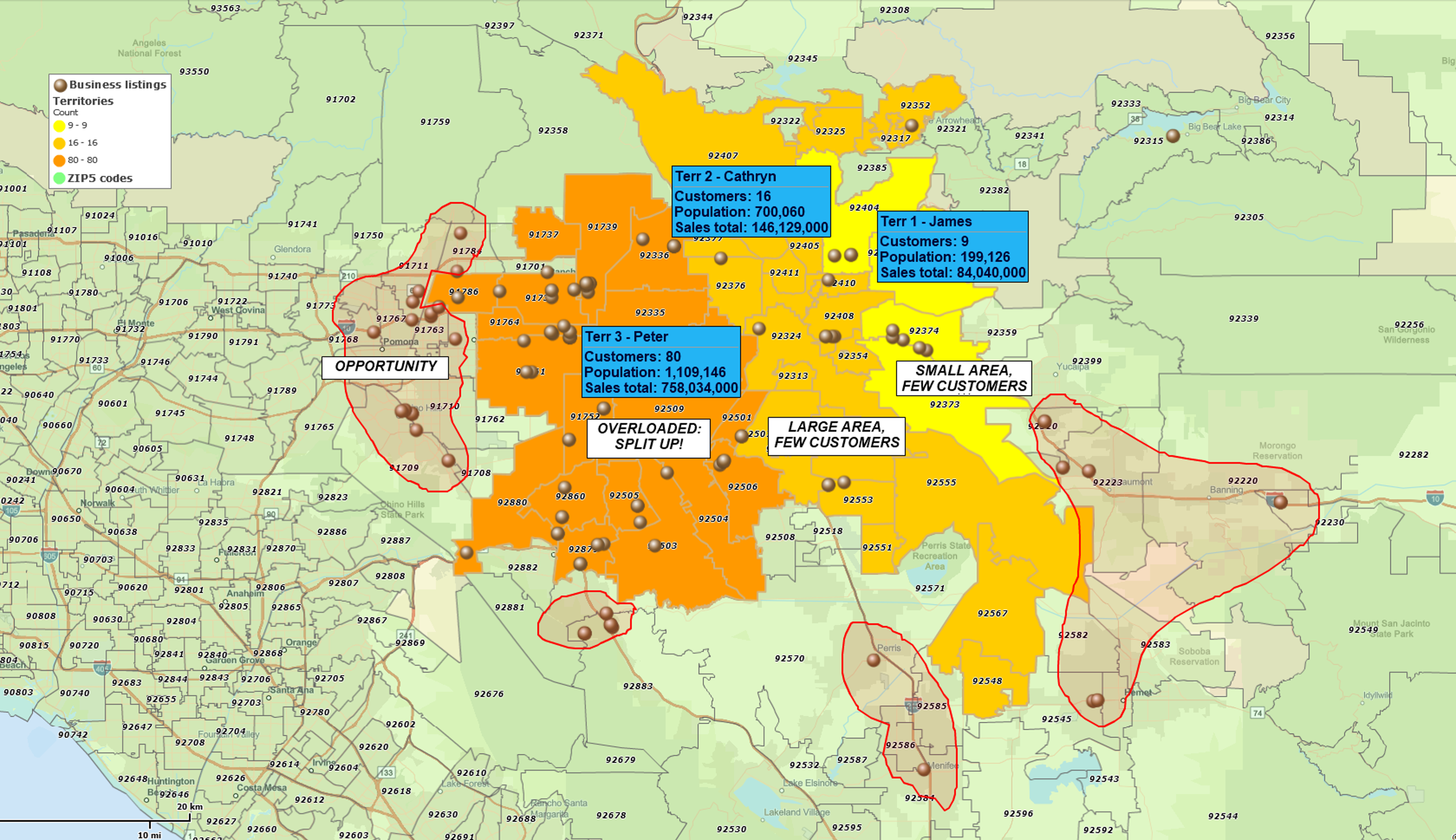

Map 2 – Territory Balance Map (Workload vs. Opportunity)

What this map tells you

- Which territories are overloaded with accounts or revenue

- Which territories have too little opportunity for the current coverage

- Whether your sales quotas and expectations are realistic

What to do in MapBusinessOnline

- Start with your territory map in Map 1

- Color-code territories by:

- Number of customers, or

- Total revenue/sales potential

- Add key demographic or business data in the background (for example, population, households, or businesses filtered by NAICS industry code in your target segment)

- Compare territory workload (customers/revenue) to market potential (demographics/business counts)

What to look for

- Territories that carry far more customers or revenue than neighboring territories

- Very large territories with relatively few accounts

- Territories where potential is high but performance is lagging (prime candidates for extra focus)

Map 3 – Growth Map (New Potential Markets and Whitespace)

What this map tells you

- Which areas look like your best-performing territories but have low penetration

- Where you have clear whitespace for campaigns, new reps, or new locations

- Which markets to grow, defend, or monitor going forward

What to do in MapBusinessOnline

- Pick one or two of your best territories from Map 2 (strong performance and strong potential)

- Note their common traits: customer density, revenue, key demographics, business mix

- Highlight ZIPs or counties outside of your current coverage that:

- Match your “best territory” characteristics, and

- Have few or no customers in your data

What to look for

- High-potential ZIPs or regions sitting just outside or between your current territories

- Natural candidates for:

- Territory splits or new territories

- Targeted campaigns

- New locations or partner focus

Sharing the Results with Your Team

Once you’ve built any of these maps, you can:

- Export maps as images or PDFs for planning decks and leadership reviews

- Share live interactive maps with colleagues so they can zoom in, filter, and explore the data themselves

That changes territory and market discussions from spreadsheet debates into map-based conversations everyone can see and understand.

Related Reading

How to Prepare for Sales Territory Mapping — a short overview of key territory planning concepts.

Territory Mapping Overview — a practical guide to working with territory tools inside MapBusinessOnline.